A SIMPLE IRA (Savings Incentive Match Plan for Employees Individual Retirement Account) is a business retirement plan designed for small companies with 100 or fewer employees. It allows you (the employee) to contribute to a tax-advantaged retirement account through payroll deduction, while also requiring your employer to make a contribution to the account. SIMPLE IRAs can’t be combined with other types of business retirement plans (i.e 401(k), profit sharing, etc) and are typically established by your employer because they are easier to manage and administer than other business retirement plans. New SIMPLE IRA plans must be established between January 1 and October 1 of the year your employer wants to start. Overall, it is a great retirement vehicle for many small businesses to help their employees save for retirement.

-

Designed for small businesses with 100 or fewer employees

- Easy way for you (the employee) to save for retirement through payroll deductions.

-

You can contribute up to a set contribution limit each year

-

Your employer must also chip in (either with a match or non-elective contribution)

- Your elected deferrals can either be Roth or pre-tax, but employer contributions are always pre-tax

- Your money can be invested in things like stocks, bonds and mutuals funds

Contributions

Plan Eligibility

There are no age or service requirements for plan eligibility, instead eligibility is based upon prior years compensation. At a maximum, you will be eligible to participate in your company’s SIMPLE IRA when:

- You’ve earned at least $5,000 in any two prior calendar years (not necessarily consecutive).

- Are expected to earn at least $5,000 in the current calendar year.

Examples of plan eligibility

Examples with plan rules that state you (the employee) must earn at least $5,000 in any two prior calendar years.

Example one

- 2023: You earned $7,500.

- 2024: You earned $8,000.

- 2025: You expect to earn $6,000.

Result: You’re eligible for 2025. You’ve got $5,000+ in two prior years (2023 and 2024), and you expect $5,000+ this year.

Example Two

- 2023: You didn’t work there (or earned $0).

- 2024: You earned $6,000.

- 2025: You expect to earn $7,500.

Result: You’re not eligible for 2025. You only have one prior year (2024) with $5,000+, not two. You’d need to wait until 2026, when 2024 and 2025 count as your two years.

Plan Entry Date / Annual Election Period

For example: The eligibility rules state you must earn at least $5,000 in any two prior calendar years. In 2024 you earned $60,000. It is now 2025 and you have earned at least $5,000 in 2025. Even though you reached the $5,000 threshold in 2025, you will have to wait till 2026 to start participating in the SIMPLE IRA (but you will receive that written notice by November 2 of 2025 and then select your deferrals between Nov 2 to Dec 31 for 2026).

Mid-year Exception –However uncommon – your employer can design a SIMPLE IRA to allow mid-year entry for new hires. The SIMPLE IRA will typically have no eligibility requirements and have language in the plan documents like “New employees may begin participation immediately upon hire” instead of “Participation begins January 1 of the following year”. If your employer does allow for mid-year entry, your employer must inform you of your right to participate (typically within 30 days of hire) and then you can begin to participate in SIMPLE IRA as soon as your first paycheck. By instantly becoming a participant in the SIMPLE IRA, you will also receive the match or non-elective employer contribution for that year.

Contribution Limits

Employee Elective Deferrals

- Pre-tax – Deferrals are taken from your paycheck before federal income taxes are withheld (Social Security and Medicare taxes (FICA) still apply upfront). Then the account grows deferred and taxes are paid upon withdrawal. These type of contributions are typical for high-income earners that believe they will be in a lower tax bracket in retirement.

- Roth – Deferrals are taken from your paycheck after-tax (you pay tax now) and then your account grows tax-free. These contributions are typical for individuals that believe they will be in a higher tax bracket in retirement than they are today.

In many instances, your plan may not allow for Roth elective deferral contributions – leaving you with the only option of pre-tax deferral contributions. However, if your employer does allow Roth, you can mix both pre-tax and roth contributions if you so choose and if the plan allows it.

Employer Contributions

An employer must make either matching or nonelective contributions to all eligible employees. A SIMPLE IRA plan can’t require you (the employee) to be employed on any specific day, such as the last day of the year, to receive matching or nonelective contributions. So if you’re eligible, you will receive the employer contribution for that year even if you leave your employer mid year.

All employer contributions go in as pre-tax and must be deposited into your account by at least your employer’s tax-filing deadline (for most employers that is around April), but this can also be extended if they file a tax extension (so around October). You (the employee) cannot designate employer contributions as Roth, like how you might be able to do so with your own elective deferrals. Contributions by your employer are tax-deductible for the company and avoid FICA tax on the contribution amount. Lastly, your employer is required to make a contribution to each eligible employees SIMPLE IRA under one of the following formulas below:

- Matching formula: The employer will match dollar-for-dollar up to 3% of the employees compensation limit.

-

- A specials rule allows your employer to elect a lower rate (but not less than 1%) in no more than two out of any five years.

-

- Non-elective formula: The employer will make a non-elective contribution of 2% of compensation, up to the compensation limit, to each eligible employee (regardless of the employee’s salary deferral contribution, if any)

For employers with greater than 25 employees, they have the option to alter their mandatory matching or non-elective contribution formulas to a higher amount. By doing so, it gives their employees a higher deferral limit (please refer to the above section “contribution limits“). The mandatory matching and non-elective formulas would be altered to:

- Matching formula: The employer will match dollar-for-dollar up to 4% of the employees compensation limit.

- Non-elective formula: The employer will make a non-elective contribution of 3% of compensation, up to the compensation limit, to each eligible employee (regardless of the employee’s salary deferral contribution, if any)

On top of the mandatory contributions, your employer may and can make additional nonelective contributions to a SIMPLE IRA plan. The additional contributions must be made in a uniform manner and may not exceed the lesser of: up to 10% of compensation (limited by the compensation limit) or $5,000 (for 2024).

Vesting

Vesting typically refers to the process of gaining ownership over the contributions your employer makes into your account. Unlike other business retirement plans, SIMPLE IRA are 100% vested immediately. This means if you were to leave the company at anytime, you would retain control over both your elective deferrals and your employer contributions.

Rollovers Into: SIMPLE IRA

A rollover is a tax-free distribution of funds from one retirement plan to another eligible retirement plan, with the contribution to the second plan referred to as a “rollover contribution.” There are several compelling reasons to consider rolling funds from another retirement plan into a SIMPLE IRA. These include simplifying account management, accessing a broader range of investment options, and potentially benefiting from lower fees in the SIMPLE IRA.

Rollover Chart: Which Retirement Accounts Are Allowed To Be Rolled Into A SIMPLE IRA

More on Rollovers – Individuals Can Perform a Rollover in The Following Ways:

- Direct rollover – An account holder must request instructions from their plan administrator. Typically, a check is made payable to the new 401(k) or IRA custodian (e.g., “Fidelity Investments FBO [Your Name]”) and sent directly to the new plan. No taxes are withheld from the transfer amount because the funds do not pass through the individual’s hands.

- Trustee-to-trustee transfer – The trustee or custodian of one plan transfers the rollover amount directly to the trustee or custodian of another plan. This is common for IRA-to-IRA transfers. No taxes are withheld, and the individual does not take possession of the funds.

- 60-day rollover – If a distribution from an IRA or retirement plan is paid directly to you (e.g., a check in your name), you can deposit all or a portion of it into an eligible retirement plan within 60 days. For distributions from a retirement plan like a 401(k), taxes (typically 20%) are withheld, so you’ll need to use other funds to roll over the full pre-tax amount. For IRA distributions, taxes are not automatically withheld unless requested. Note: Only one IRA-to-IRA 60-day rollover is allowed per 12-month period (this limit does not apply to direct rollovers, trustee-to-trustee transfers, or rollovers involving employer plans).

Investments

You (the employee) are responsible for managing the investments inside your SIMPLE IRA. You will need to select and invest within the investment options offered to you by the financial institution holding the account (i.e. bank, brokerage firm, etc.). Typically, these institutions will allow you to choose from a wide range of investment options including mutual funds, stocks, bonds, ETFs, CDs & money market funds. However, you can’t invest in things like collectibles, life insurance or certain real estate deals. Ultimately, the financial institution holding your SIMPLE IRA will provide you with the investment options you are allowed to make.

Distributions

The 2-Year Rule

Distribution Before 59½

Withdrawing from a SIMPLE IRA before age 59½ generally triggers taxes and early withdrawal penalties. If the withdrawal occurs within the first two years of participation (dated from the initial contribution), a 25% penalty applies, reducing to 10% thereafter, unless an early withdrawal penalty exception is met. You’ll also owe ordinary income tax on taxable portions of the distribution. Your SIMPLE IRA may contain both Roth and pre-tax funds, and the tax and penalty outcomes depend on your account structure and custodian’s distribution process. Contact your custodian to confirm their method, especially if you’re within the two-year window or have mixed contributions, to plan your withdrawal and tax impact effectively. Below are the possible distribution methods:

Fixed Distribution – If your SIMPLE IRA includes both Roth and pre-tax funds and follows a fixed withdrawal order—typically when tracked as separate sub-accounts—the sequence may mirror Roth and Traditional IRA principles:

- Roth contributions – Withdrawn first, always tax- and penalty-free, even within two years, as these are after-tax funds.

- Pre-tax contributions – Withdrawn next, taxed as ordinary income and subject to a 25% penalty (within two years) or 10% (after), unless an early penalty exception applies.

- Earnings – Withdrawn last, with tax and penalty treatment depending on their source:

- Roth Earnings: Taxed as ordinary income plus penalized for early withdraw (25% within two years, 10% after) unless an early withdrawal exception applies.

- Pre-Tax Earnings: Taxed as ordinary income plus the same 25% or 10% early withdrawal penalty, unless an early withdrawal exception applies.

Example - Fixed Distribution

Let’s walk through a detailed example of withdrawing from a SIMPLE IRA before age 59½, showing how the fixed order—Roth contributions, pre-tax contributions, then earnings—plays out with taxes and penalties.

- Account Holder: Jane, age 40, self-employed with a SIMPLE IRA she started in 2024.

- SIMPLE IRA Balance on March 1, 2025: $35,000

- Roth Contributions: $10,000 (after-tax employee deferrals from 2024 and 2025)

- Pre-Tax Contributions: $15,000 (employer contributions from 2024 and 2025—Jane’s her own employer)

- Earnings: $10,000

- Roth Earnings: $4,000 (40%)

- Pre-Tax Earnings: $6,000 (60%)

- Withdrawal Date: June 1, 2025—within 2 years of her first contribution (say, January 1, 2024), so the 25% penalty applies.

- Withdrawal Amount: $25,000

Withdrawal Breakdown – Jane’s SIMPLE IRA follows the fixed order: Roth contributions, pre-tax contributions, then earnings. Her custodian processes it, and here’s how it shakes out:

- Roth Contributions

- Amount: All $10,000 of Roth contributions come out first.

- Tax: $0— tax-free

- Penalty: $0—no penalty

- Pre-Tax Contributions

- Amount: $15,000 of pre-tax contributions come out second

- Tax: Taxed as ordinary income.

- Penalty: Within 2 years, so 25% applies

- Earnings – split proportionally (40% Roth, 60% pre-tax)

- Roth: $2,000

- Tax: Taxed as ordinary income.

- Penalty: Within 2 years, so 25% applies

- Pre-tax: $3,000

- Tax: Taxed as ordinary income.

- Penalty: Within 2 years, so 25% applies

- Roth: $2,000

Select Which “Bucket” – If your custodian maintains separate sub-accounts for Roth and pre-tax funds, you may choose which “bucket” to withdraw from, allowing strategic tax planning:

Roth Bucket- When a withdrawal happens inside your Roth “bucket”, it gets a little complicated. The Roth bucket is split between contributions (your basis) and earning. Distributions follow a specific order when a distribution occurs inside your Roth account.

- Contributions – Come out first, tax- and penalty-free (since taxes were paid upfront), even within two years.

- Earnings – Follow next, taxed as ordinary income (since it is non-qualified) and subject to a 25% penalty (within two years) or 10% (after), unless an early withdrawal penalty exception applies.

Pre-tax Bucket – Withdrawals are straightforward—taxed as ordinary income plus a 25% penalty (within two years) or 10% (after), unless an early withdrawal exception applies.

Pro-Rata Distribution – If your account combines Roth and pre-tax funds without separation, withdrawals may consist of a proportional mix based on their shares. For example, if your SIMPLE IRA is 70% pre-tax (contributions and earnings) and 30% Roth (contributions and earnings), a withdrawal reflects that 70/30 split:

- Roth portion – Contributions (the basis) within the Roth portion of the distribution are tax and penalty free (even within two years). Earning are taxed as ordinary income, and incurs the 10% (after two years) or 25% (within two years) early withdrawal penalty, unless an early withdrawal penalty exemption applies.

- Pre-Tax portion – Taxed as ordinary income with a 25% penalty (within two years) or 10% (after), unless an early withdrawal penalty exception applies.

Example - Pro-rata Example

Let’s walk through a detailed example of withdrawing from a SIMPLE IRA before age 59½, showing how the fixed order—Roth contributions, pre-tax contributions, then earnings—plays out with taxes and penalties.

- Account Holder: Jane, age 40, self-employed with a SIMPLE IRA she started in 2024.

- SIMPLE IRA Balance on March 1, 2025: $35,000

- Roth Contributions: $10,000 (after-tax employee deferrals from 2024 and 2025)

- Pre-Tax Contributions: $15,000 (employer contributions from 2024 and 2025—Jane’s her own employer)

- Earnings: $10,000

- Roth Earnings: $4,000 (40%)

- Pre-Tax Earnings: $6,000 (60%)

- Withdrawal Date: June 1, 2025—within 2 years of her first contribution (say, January 1, 2024), so the 25% penalty applies.

- Withdrawal Amount: $25,000

Pro-rata break down

- Total account balance: $35,000

- Roth Contributions: $10,000 ÷ $35,000 = 28.57% (after-tax, tax- and penalty-free)

- Pre-Tax Contributions: $15,000 ÷ $35,000 = 42.86% (taxable and subject to penalty)

- Total Earnings: $10,000 ÷ $35,000 = 28.57%

- Roth Earnings: $4,000 ÷ $35,000 = 11.43% (taxable and penalized since non-qualified)

- Pre-Tax Earnings: $6,000 ÷ $35,000 = 17.14% (taxable and subject to penalty)

Withdrawal Breakdown

- Roth Contributions = 28.57% × $25,000 = $7,142.50

- Tax: $0— tax-free

- Penalty: $0—no penalty

- Pre-Tax Contributions= 42.86% × $25,000 = $10,715.00

- Tax: Taxed as ordinary income.

- Penalty: Within 2 years, so 25% applies

- Earnings= 28.57% × $25,000 = $7,142.50

- Roth: 11.43% × $25,000 = $2,857.50

- Tax: Taxed as ordinary income.

- Penalty: Within 2 years, so 25% applies

- Pre-tax: 17.14% × $25,000 = $4,285.00

- Tax: Taxed as ordinary income.

- Penalty: Within 2 years, so 25% applies

- Roth: 11.43% × $25,000 = $2,857.50

Exceptions to the early withdrawal penalty

- First-Time Home: Up to $10,000 (lifetime limit) for buying, building, or rebuilding a home for you, your spouse, kids, or grandkids.

- Medical Expenses: Unreimbursed costs over 7.5% of your adjusted gross income (AGI).

- Health Insurance: If unemployed and on benefits for 12+ weeks, to pay premiums.

- Education: Tuition, books, etc., for you, spouse, kids, or grandkids.

- Disability: If you’re permanently disabled (IRS definition).

- SEPP (72(t) Payments): Substantially equal periodic payments over your life expectancy—locks you in for 5 years or until 59½, whichever’s longer.

- Death: If you die, beneficiaries avoid penalties

Distribution After 59½

Withdrawals from a SIMPLE IRA after age 59½ are free from IRS early withdrawal penalties, providing greater flexibility than distributions before this age. The two-year rule, which imposes a 25% penalty on early withdrawals within two years of the initial contribution, no longer applies for penalty purposes, though it still prohibits rollovers to non-SIMPLE IRAs during that period. If your SIMPLE IRA includes both Roth (after-tax employee contributions) and pre-tax funds, the tax treatment depends on your account setup and custodian’s distribution process. Confirm with your custodian how they handle withdrawals, especially if you have Roth contributions, to plan your tax impact accurately. Below are the potential distribution methods:

Fixed Distribution – If your SIMPLE IRA tracks Roth and pre-tax funds as separate sub-accounts and follows a fixed withdrawal order, the sequence typically aligns with Roth and Traditional IRA principles:

- Roth contributions – Withdrawn first, always tax- and penalty-free, as these are after-tax funds.

- Pre-tax contributions – Withdrawn next, taxed as ordinary income, with no penalty.

- Earnings – Withdrawn last, with tax treatment based on their source:

- Roth Earnings: Tax-free if qualified (age 59½ and the five-year holding period, starting from the first Roth contribution, is met); otherwise, taxed as ordinary income. No penalty.

- Pre-Tax Earnings: Taxed as ordinary income, with no penalty.

Select Which “Bucket” – If your custodian maintains separate sub-accounts for Roth and pre-tax funds, you may choose which portion to withdraw from, offering strategic tax planning:

Roth Bucket – When you withdraw from the Roth bucket, it gets a little complicated because the Roth bucket is split between contributions (your basis) and earning. Distributions follow a specific order when a distribution occurs inside the Roth account.

- Contributions – Withdrawn first, tax- and penalty-free, since taxes were paid upfront.

- Earning – Withdrawn next, tax-free if qualified (five-year holding period met); otherwise, taxed as ordinary income. No penalty.

Pre-tax Bucket – Withdrawals are taxed as ordinary income, with no penalty.

Pro-Rata Distribution – If your account combines Roth and pre-tax funds without separation, withdrawals reflect a proportional mix based on their shares. For example, if your SIMPLE IRA is 70% pre-tax (contributions and earnings) and 30% Roth (contributions and earnings), a withdrawal follows that 70/30 split:

- Roth portion – Contributions (the basis) within the Roth share are tax and penalty free. Earning are tax-free if qualified (five-year holding period met); otherwise, taxed as ordinary income. No penalty.

- Pre-Tax portion – Taxed as ordinary income, with no penalty.

RMDs (Required Minimum Distributions)

Side note (Roth “bucket”): Your SIMPLE IRA may include both Roth (after-tax) and pre-tax funds. For RMD purposes, the entire account balance—including Roth contributions and earnings—must be included in the RMD calculation, as IRS rules currently treat SIMPLE IRAs as a single account with no exemption for Roth portions. While some custodians might track Roth and pre-tax funds in separate sub-accounts, selective rollovers of just the Roth “bucket” to a Roth IRA may or may not permitted under current IRS guidelines. Consult your custodian to confirm their policies and options.

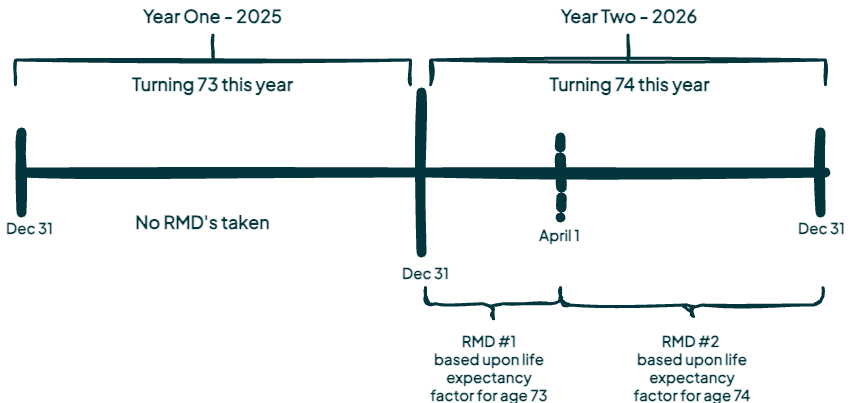

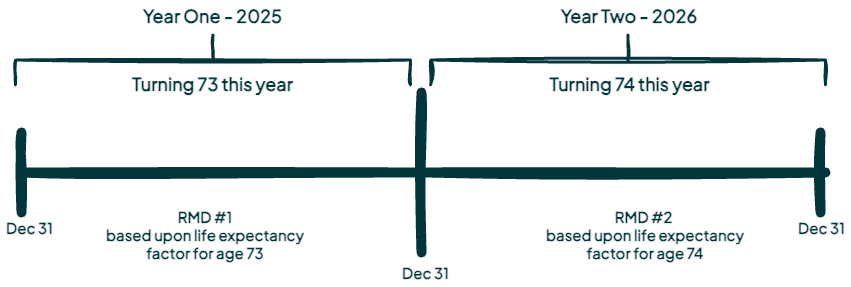

Turning 73? See how your first RMD timeline may work

Option One – take your first RMD in the following year before April 1st and your second RMD in the same year before December 31st. This option will give you two RMDs in year two, thus increasing the probability that the RMDs will push you in a higher tax bracket.

Option Two – take your first RMD in the year you turn 73 and your second RMD the following year before DEcember 31st. This option will split the RMDs between two years, which is less likely to push you into a higher tax bracket than option one.

Option Two – take your first RMD in the year you turn 73 and your second RMD the following year before DEcember 31st. This option will split the RMDs between two years, which is less likely to push you into a higher tax bracket than option one.

Rollovers Out: From SIMPLE-IRA

There are many reasons why you may want to do rollout funds from your SIMPLE IRA, among them may be to consolidate your retirement accounts, lower your fees or you have better investment options elsewhere. Most direct rollovers are a tax and penalty free distribution. You typically perform a rollover when your employment terminates but you can also do rollovers for other situations. The 2-year rule is key: within two years of the first contribution, rollovers to anything other than another SIMPLE IRA are treated as taxable distributions by the IRS. This rule applies whether you’re above or below age 59½, though SIMPLE IRA-to-SIMPLE IRA rollovers are always allowed without restriction.

Rollover Chart: Which Retirement Accounts Are Allowed To Accept A SIMPLE IRA Rollover

I am text block. Click edit button to change this text.

FAQs

What is a SIMPLE IRA, and who can use it?

A SIMPLE IRA (Savings Incentive Match Plan for Employees) is a retirement plan designed for small businesses with 100 or fewer employees who earned at least $5,000 in the prior year. It lets employees save through payroll deductions while requiring employers to contribute, making it an easy, low-cost option compared to plans like 401(k)s.

What happens to my SIMPLE IRA if I leave my job?

Your SIMPLE IRA is 100% vested immediately, so you keep all contributions—yours and your employer’s—when you leave. You can leave it with the custodian, roll it into another SIMPLE IRA (anytime), or roll it to a Traditional IRA, Roth IRA, or other plan (after two years from the first contribution) without taxes or penalties if done directly.

Do I have to take money out of my SIMPLE IRA when I get older?

Yes, Required Minimum Distributions (RMDs) start at age 73, even if you’re still working. Your first RMD is due by April 1 of the year after you turn 73, then by December 31 each year after. RMDs are calculated using your prior year-end balance and IRS life expectancy tables. Roth portions are included, but you can roll them into a Roth IRA (after two years) to avoid RMDs.

Can I have both a SIMPLE IRA and a 401(k) at the same time?

A company can’t have a SIMPLE IRA and another employer-sponsored retirement plan (like a 401(k), SEP IRA, or profit-sharing plan) at the same, in the same tax year. A SIMPLE IRA is an exclusive plan for small businesses, so your employer must choose one or the other. However, if you work for multiple employers, you could participate in a SIMPLE IRA at one job and a 401(k) at another.

Can I contribute to both a IRA and SIMPLE IRA at the same time?

Does a SIMPLE IRA balance affect backdoor Roth IRA contributions?

A SIMPLE IRA balance doesn’t directly block backdoor Roth IRA contributions, but its pre-tax portion impacts the tax treatment of your conversion under the pro-rata rule. If your SIMPLE IRA has significant pre-tax funds, it could make part of your backdoor Roth conversion taxable, reducing its benefits. Plan carefully, considering rollovers, Roth contributions, and timing (especially the 2-year rule), and consult a tax professional for your unique circumstances.